What is short float meaning?

Short float is a measure of the number of shares of a company's stock that are currently being sold short. A high short float indicates that a large number of investors are betting that the stock price will fall. This can be a sign of bearish sentiment or it can simply indicate that the stock is overvalued.

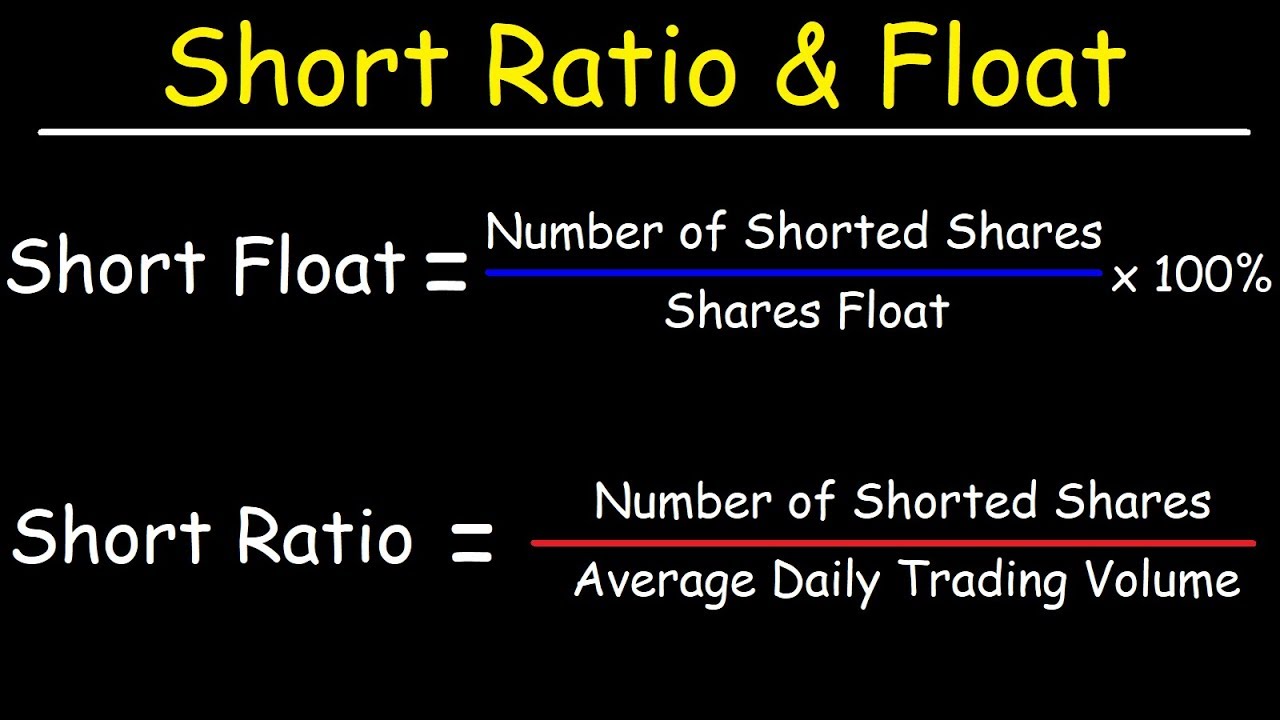

Short float is calculated by dividing the number of shares sold short by the total number of shares outstanding. A short float of 10% means that 10% of the company's shares are currently being sold short.

Short float is an important metric to watch because it can give investors an idea of the potential for a stock to rise or fall. A high short float can indicate that the stock is due for a correction, while a low short float can indicate that the stock is undervalued.

Short float is also used by traders to identify potential short-selling opportunities. Traders who believe that a stock is overvalued may short the stock in the hope of profiting from a decline in the stock price.

Short float is a complex metric that can be difficult to interpret. However, it is an important metric to be aware of, as it can provide investors with valuable insights into the potential for a stock to rise or fall.

Short Float Meaning

Short float meaning encompasses several key aspects that shape its significance in the financial markets. These aspects provide a comprehensive understanding of this important metric:

- Availability of Shares: Short float indicates the number of shares available for short selling.

- Supply and Demand: High short float suggests high demand for borrowing shares to short, potentially driving down the stock price.

- Market Sentiment: A large short float can reflect negative investor sentiment, anticipating a stock price decline.

- Potential Volatility: High short float increases the likelihood of significant price swings, both upward and downward.

- Short Squeeze: A sudden surge in demand for shares can trigger a short squeeze, forcing short sellers to buy back shares at a higher price.

- Trading Strategy: Short float data aids traders in identifying potential short-selling opportunities or hedging against downside risk.

These aspects collectively highlight the relevance of short float meaning in assessing market sentiment, predicting price movements, and making informed investment decisions. Understanding these dimensions empowers investors to navigate the complexities of the financial markets effectively.

1. Availability of Shares: Short Float Indicates the Number of Shares Available for Short Selling

The availability of shares for short selling is a crucial aspect of short float meaning. Short float measures the number of shares of a company's stock that are currently being sold short. The availability of shares for short selling directly influences the short float and the potential price movements of the stock.

- Supply and Demand Dynamics: The availability of shares for short selling affects the supply and demand dynamics in the market. A high availability of shares for short selling indicates a greater supply of shares, which can potentially lead to lower demand and, consequently, a decline in the stock price.

- Short Seller Sentiment: The availability of shares for short selling also reflects the sentiment of short sellers. A large number of shares available for short selling may indicate that short sellers are confident in their bearish outlook for the stock and anticipate a price decline.

- Borrowing Costs: The availability of shares for short selling influences the borrowing costs for short sellers. When shares are scarce, short sellers may have to pay higher borrowing costs, making it more expensive to maintain their short positions.

- Short Squeeze Potential: The availability of shares for short selling plays a role in determining the potential for a short squeeze. If the availability of shares for short selling is limited, a sudden increase in demand for the stock can trigger a short squeeze, forcing short sellers to cover their positions by buying back shares, potentially driving the price higher.

In summary, the availability of shares for short selling is an integral part of short float meaning. It affects supply and demand dynamics, reflects short seller sentiment, influences borrowing costs, and plays a role in determining the potential for a short squeeze. Understanding this aspect provides valuable insights into the dynamics of short selling and its impact on stock price movements.

2. Supply and Demand: High short float suggests high demand for borrowing shares to short, potentially driving down the stock price.

The relationship between supply and demand is a fundamental concept in economics, and it plays a significant role in understanding short float meaning. In the context of short selling, supply and demand dynamics influence the availability of shares for short selling and the potential price movements of the stock.

- Increased Demand for Borrowing Shares: A high short float indicates that there is a high demand for borrowing shares to short. This increased demand can drive up the borrowing costs for short sellers, making it more expensive to maintain their short positions. As a result, short sellers may be more likely to close their positions, which can lead to a decrease in the short float and an increase in the stock price.

- Limited Supply of Shares: In some cases, the supply of shares available for short selling may be limited. This can occur when a large proportion of the company's shares are held by long-term investors or when the company has implemented measures to restrict short selling. A limited supply of shares can make it difficult for short sellers to borrow shares, which can further drive up borrowing costs and potentially lead to a short squeeze.

- Impact on Stock Price: The interplay of supply and demand for shares to short can have a significant impact on the stock price. A high short float and high demand for borrowing shares can put downward pressure on the stock price, as short sellers sell borrowed shares in the market. Conversely, a decrease in short float and a reduction in demand for borrowing shares can lead to an increase in the stock price.

In summary, the relationship between supply and demand is a key aspect of short float meaning. High short float and high demand for borrowing shares can potentially drive down the stock price, while a decrease in short float and a reduction in demand can lead to an increase in the stock price. Understanding these dynamics is crucial for investors and traders who want to make informed decisions about short selling and its potential impact on stock prices.

3. Market Sentiment: A large short float can reflect negative investor sentiment, anticipating a stock price decline.

The relationship between market sentiment and short float meaning is crucial. A large short float can be a strong indicator of negative investor sentiment towards a particular stock. This negative sentiment often stems from expectations of a decline in the stock price.

- Investor Perception: A high short float suggests that a significant number of investors believe the stock is overvalued or has a bearish outlook. This perception can drive demand for borrowing shares to short, leading to an increase in the short float.

- Contrarian Indicator: While a large short float can indicate negative sentiment, it can also be a contrarian indicator. Some investors view a high short float as an opportunity to buy the stock, betting against the pessimistic market sentiment.

- Short-Term Impact: In the short term, a high short float can contribute to downward pressure on the stock price. As short sellers sell borrowed shares, it increases the supply of shares in the market, potentially driving down the price.

- Long-Term Implications: However, the long-term implications of a large short float are less clear. While it can indicate negative sentiment, it does not guarantee a stock price decline. Other factors, such as company fundamentals and overall market conditions, also play a role in determining the stock's performance.

Overall, understanding the connection between market sentiment and short float meaning is essential for investors. A large short float can provide valuable insights into market sentiment and potential price movements, but it should be considered in conjunction with other factors to make informed investment decisions.

4. Potential Volatility: High short float increases the likelihood of significant price swings, both upward and downward.

The relationship between potential volatility and short float meaning is significant. A high short float can create conditions that increase the likelihood of substantial price swings, both upward and downward.

- Short Squeeze Potential: A high short float can amplify the potential for a short squeeze. When the demand for a stock increases rapidly, short sellers may be forced to buy back their borrowed shares to cover their positions. This buying pressure can lead to a surge in the stock price, resulting in a short squeeze.

- Downward Pressure: Conversely, a high short float can also contribute to downward pressure on the stock price. As short sellers sell borrowed shares, it increases the supply of shares in the market, which can drive the price down. This downward pressure can be exacerbated if negative news or events reinforce the bearish sentiment.

- Increased Market Attention: A high short float often attracts the attention of market participants, including traders and institutional investors. This increased attention can lead to higher trading volume and volatility, as different market players take positions based on their expectations of the stock's price movement.

- Impact on Option Premiums: High short float can also affect the premiums of options contracts. Options traders may demand higher premiums for options that give them the right to sell the stock (put options) due to the increased potential for downward price swings.

Understanding the connection between potential volatility and short float meaning is crucial for investors and traders. A high short float can signal the potential for significant price movements, both upward and downward. This knowledge can help investors make informed decisions about whether to enter or exit positions and can assist traders in identifying potential trading opportunities.

5. Short Squeeze: A sudden surge in demand for shares can trigger a short squeeze, forcing short sellers to buy back shares at a higher price.

A short squeeze is a phenomenon that occurs when a stock's price rises rapidly, forcing short sellers to buy back shares to cover their short positions. This surge in demand can lead to a further increase in the stock price, creating a positive feedback loop.

Short squeezes are often triggered by a combination of factors, including a high short float, positive news or events, and a shift in market sentiment. A high short float indicates that a large number of shares are being sold short, creating a large pool of potential buyers if the stock price starts to rise.

When a short squeeze occurs, short sellers are forced to buy back shares to cover their positions, which further drives up the stock price. This can lead to significant losses for short sellers and can also create opportunities for investors who have bought the stock in anticipation of a short squeeze.

Understanding the connection between short squeezes and short float meaning is crucial for investors and traders. A high short float can increase the likelihood of a short squeeze, while a low short float makes a short squeeze less likely. This knowledge can help investors make informed decisions about whether to enter or exit positions and can assist traders in identifying potential trading opportunities.

6. Trading Strategy: Short float data aids traders in identifying potential short-selling opportunities or hedging against downside risk.

The relationship between trading strategy and short float meaning is significant. Short float data provides valuable insights that can inform trading decisions and risk management strategies.

- Identifying Short-Selling Opportunities: A high short float can indicate that a stock is overvalued or has a bearish outlook. Traders may use this information to identify potential short-selling opportunities, betting on the stock's price to decline.

- Hedging Against Downside Risk: Traders can also use short float data to hedge against downside risk in their portfolios. By identifying stocks with a high short float, traders can take offsetting positions to mitigate potential losses if the market turns against them.

- Gauging Market Sentiment: Short float data can serve as a gauge of market sentiment towards a particular stock. A high short float suggests that a large number of investors are betting against the stock, while a low short float indicates more positive sentiment.

- Monitoring Short Squeeze Potential: Traders can monitor short float data to assess the potential for a short squeeze. A high short float and a sudden increase in demand for the stock can create conditions conducive to a short squeeze, which can lead to rapid price increases.

Understanding the connection between trading strategy and short float meaning empowers traders to make informed decisions, identify potential opportunities, and manage risk effectively. By incorporating short float data into their analysis, traders can gain an edge in the competitive financial markets.

Short Float Meaning FAQs

This section addresses frequently asked questions regarding short float meaning, providing concise and informative answers to enhance your understanding.

Question 1: What is the significance of short float in stock analysis?

Short float provides valuable insights into market sentiment and potential price movements. A high short float indicates a large number of investors betting against the stock, while a low short float suggests more positive sentiment.

Question 2: How does short float affect stock prices?

Short float can influence stock prices through supply and demand dynamics. High short float can lead to increased supply of shares, putting downward pressure on the price. Conversely, a low short float can limit supply, potentially supporting higher prices.

Question 3: What is a short squeeze, and how does it relate to short float?

A short squeeze occurs when a stock's price rises rapidly, forcing short sellers to buy back shares to cover their positions. This surge in demand can further drive up the price in a positive feedback loop. High short float increases the potential for a short squeeze.

Question 4: How can traders use short float data in their strategies?

Traders use short float data to identify potential short-selling opportunities, hedge against downside risk, gauge market sentiment, and monitor the potential for short squeezes.

Question 5: What are the limitations of using short float as an investment indicator?

While short float is a useful metric, it should not be used in isolation. Other factors, such as company fundamentals and overall market conditions, also play a role in determining stock performance.

In summary, understanding short float meaning and its implications is essential for investors and traders. Short float provides insights into market sentiment, potential price movements, and trading strategies, but it should be considered alongside other relevant factors for comprehensive analysis.

Transition to the next article section: The following section explores the practical applications of short float meaning in the financial markets...

Short Float Meaning

In conclusion, short float meaning encompasses a multifaceted array of concepts that provide valuable insights into market dynamics and investment opportunities. Understanding short float enables investors and traders to gauge market sentiment, assess potential price movements, identify trading strategies, and manage risk effectively.

Short float serves as a critical indicator of market sentiment, reflecting the number of investors betting against a particular stock. High short float suggests bearish sentiment, while low short float indicates more positive sentiment. This information can be instrumental in making informed investment decisions.

Furthermore, short float plays a significant role in determining stock prices through supply and demand mechanisms. High short float can increase the supply of shares, putting downward pressure on prices. Conversely, low short float can limit supply, potentially supporting higher prices.

Traders utilize short float data to identify potential short-selling opportunities, hedge against downside risk, and monitor the potential for short squeezes. Short squeezes occur when a stock's price rises rapidly, forcing short sellers to buy back shares to cover their positions, leading to further price increases.

While short float is a useful metric, it should be considered in conjunction with other fundamental and technical indicators for comprehensive analysis. By incorporating short float meaning into their investment strategies, investors and traders can enhance their decision-making, navigate market volatility, and capitalize on potential opportunities.

You Might Also Like

Breaking News: Warner Bros. Unveils Major Studio UpdatesKash Strong: The Ultimate Guide To Building A Strong Foundation

Meet Robert Platek: The Investment Genius

Explore Our Competitive Pricing And Exceptional Packages

Inno Drive: The Perfect Driving Companion For Her

Article Recommendations